AlexSecret

Genesco Inc. (NYSE:GCO) expects to extend its retailer rely even contemplating the incoming financial recession. Monetary analysts are additionally anticipating a rise in free money movement (“FCF”) within the coming years. For my part, appropriate choice of shops, extra digitalization, and maybe acquisitions may indicate a Genesco valuation of near $85 per share. I do see dangers from altering buyer style or stock markdowns. Nevertheless, the present inventory valuation seems to undervalue considerably how a lot GCO is value.

Genesco Inc.

Contents

- 1 Genesco Inc.

- 2 Good Monetary Form

- 3 Expectations Embrace 3%-5% Gross sales Progress And EBITDA Margin Shut To 7%

- 4 Base Case State of affairs: Sufficient Digitalization And Administration Of Shops May Suggest Shut To $85 Per Share

- 5 My Worst Case State of affairs Would Deliver The Inventory Down To $42 Per Share

- 6 Conclusion

Nashville-based specialty retailer Genesco is footwear-focused. It runs near 1,400 shops within the U.S., Canada, the UK, and the Republic of Eire. The corporate combines well-known manufacturers with its personal merchandise:

Supply: PowerPoint Presentation

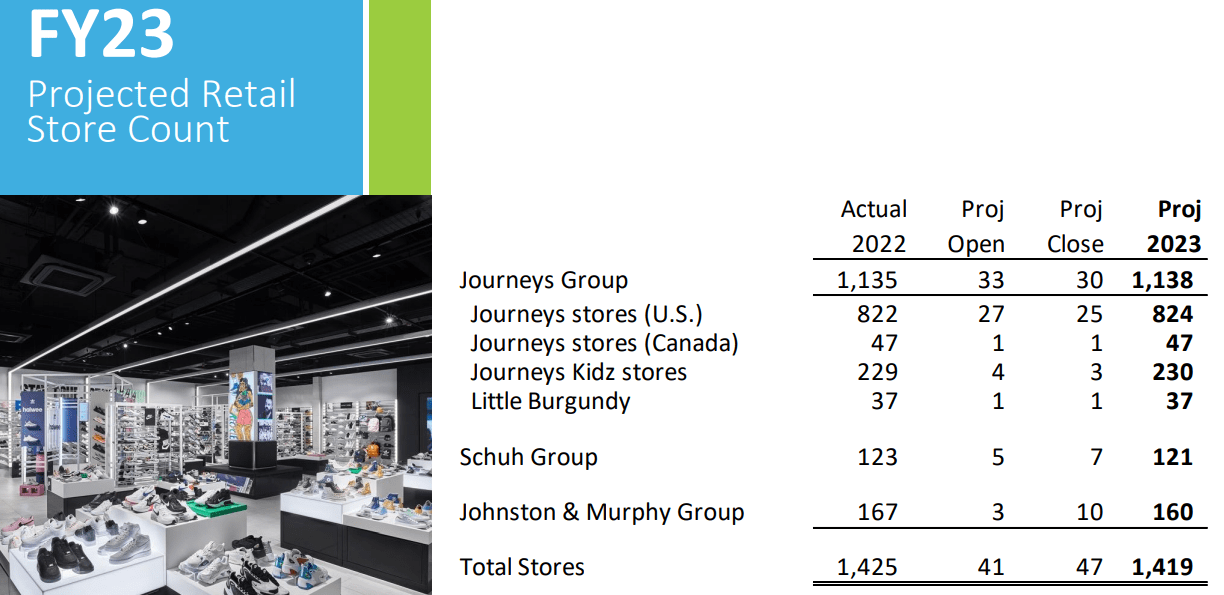

For my part, there are two important causes to assessment the corporate’s monetary figures. First, Genesco doesn’t anticipate to shut shops within the close to future. The corporate expects to open near 33 new shops and run a complete of 1,138 shops by 2023. With all people speaking about an financial recession, the truth that the variety of shops will not be anticipated to say no is, for my part, very optimistic.

Supply: PowerPoint Presentation

The second cause to love Genesco inventory is that the Board of Administrators seems to be aggressively shopping for loads of its personal inventory. For my part, if the inventory repurchase program continues within the close to future, the demand for the inventory will doubtless improve.

Over the past three years, we have now repurchased $176 million of frequent inventory at a mean worth of $51.18, or 22% of our excellent shares. Supply: PowerPoint Presentation

As of January 29, 2022, we accrued $4.8 million for share repurchases that may settle in Fiscal 2023 which is included in different accrued liabilities on the Consolidated Stability Sheets. We had been working beneath a $100.0 million repurchase authorization from September 2019. Supply: 10-k

Good Monetary Form

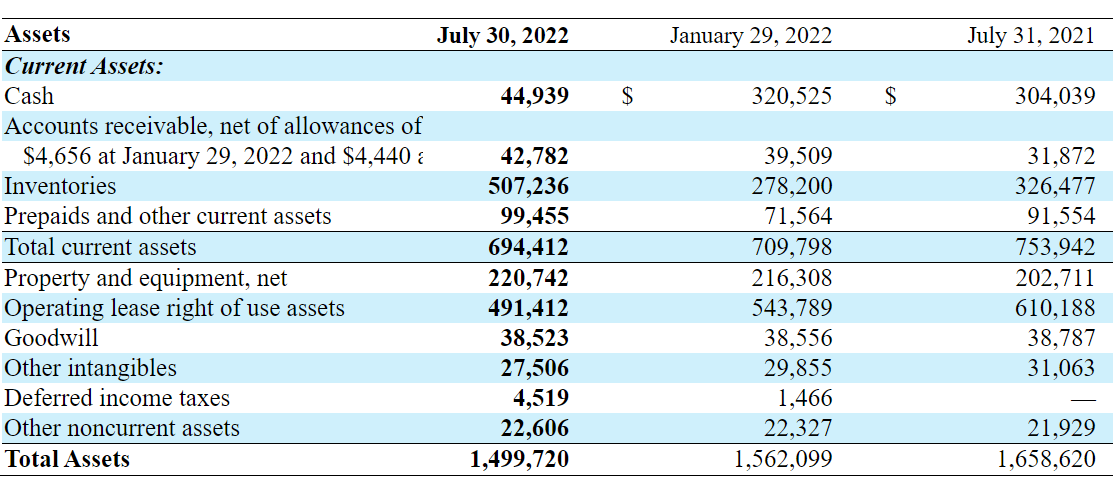

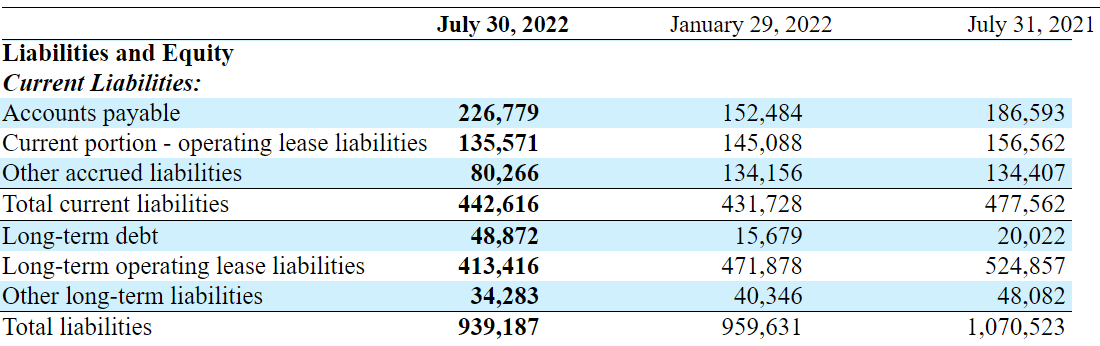

On July 30, 2022, Genesco reported whole money of $44 million, accounts receivable value $42 million, and inventories value $507 million. With whole present belongings value $694 million, I imagine that the corporate has a substantial quantity of liquidity. Complete present belongings are bigger than the present liabilities.

Genesco additionally owns property and tools value $220 million, working lease rights of use belongings of $491 million, and a small quantity of goodwill. Lastly, whole belongings had been $1.499 billion, which makes an asset/legal responsibility ratio bigger than 1x. I imagine that the corporate’s monetary scenario is in good condition.

Supply: Quarterly Outcomes From Genesco

As of July 30, 2022, Genesco additionally studies accounts payable of $226 million, working lease liabilities of $135 million, and accrued liabilities value $80 million. Complete present liabilities had been near $442 million, and long-term debt stands at $48 million, with long-term working lease liabilities of $413 million. The whole liabilities stand at $939 million. Contemplating future free money movement of greater than $99 million, for my part, the whole quantity of debt doesn’t appear worrying.

Supply: Quarterly Outcomes From Genesco

Expectations Embrace 3%-5% Gross sales Progress And EBITDA Margin Shut To 7%

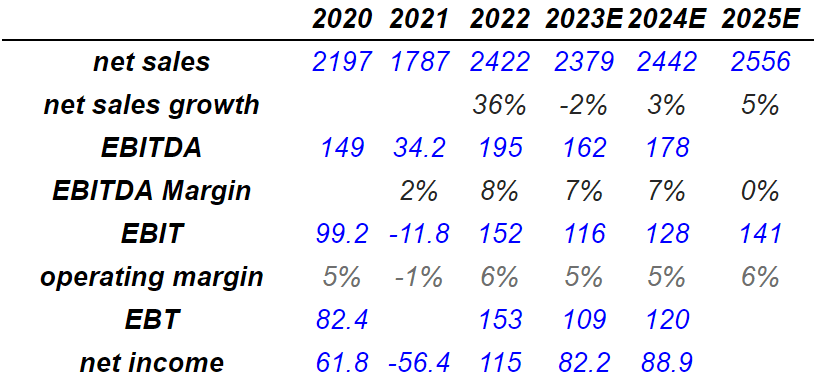

The expectations of different funding analysts for 2025 embody whole internet gross sales of $2.5 billion, with internet gross sales development of 5%. Forecasts additionally embody an EBITDA of $178 million. Concerning 2025 EBIT, analysts anticipate a sum of $141 million, with an working margin of 6%. Lastly, whole internet revenue would stand at near $89 million.

Supply: In search of Alpha

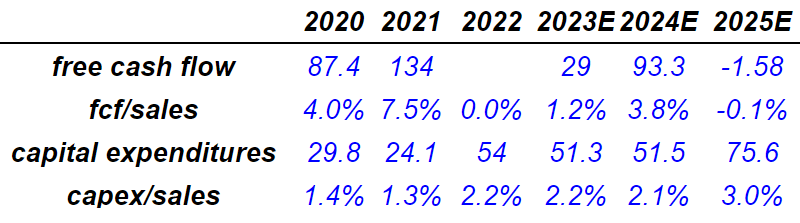

For 2024, analysts additionally forecasted free money movement of $93 million and FCF/gross sales margin near 4%. Let’s additionally be aware that the corporate doesn’t require loads of capital expenditures. In 2025, the capex/gross sales ratio stands at shut to three%.

Supply: In search of Alpha

Below my base case state of affairs, I anticipate Genesco to speed up digitalization to develop direct-to-consumer, and maximize the connection between bodily and digital channels. Below these two assumptions, I imagine that the corporate has a big room for enchancment by way of income development and free money movement development.

In addition to, if Genesco efficiently deepens shopper insights to strengthen buyer relationships, the corporate’s model might get extra status. If Genesco’s merchandise are as acknowledged as main manufacturers on the market, income development would doubtless pattern north.

Lastly, innovation and maybe pursuing synergistic acquisitions may speed up free money movement and profitability within the coming years. Let’s additionally level out that closing unprofitable shops and opening new ones is among the important pillars of the corporate’s technique. Administration defined these initiatives within the final annual report:

We anticipate optimizing our retailer footprint sooner or later, concentrating on places that we imagine might be best, in addition to closing sure shops, maybe decreasing the general sq. footage and retailer rely from present ranges, however bettering productiveness in our present places and investing in know-how and infrastructure to assist omnichannel and digital retailing. Supply: 10-k

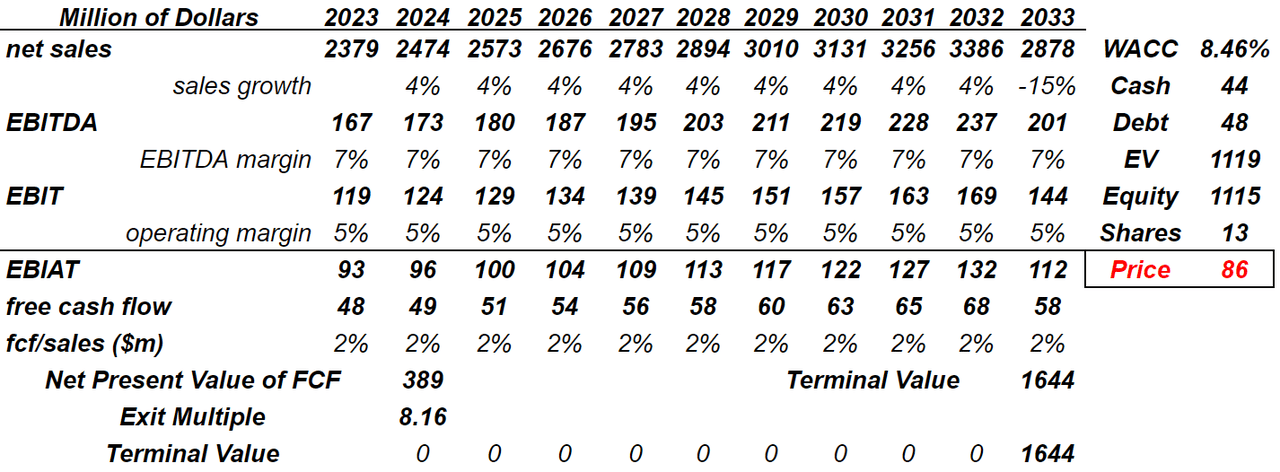

I anticipate, for 2033, a complete internet gross sales of $2.8 billion and an EBITDA of $201 million, with an EBITDA margin of seven%. Concerning EBIT, I anticipate $144 million, with an working margin of 5%. The EBIAT could possibly be near $112 million along with a free money movement of $58 million and FCF/gross sales of two%. I anticipate the web current worth of future FCF to be near $389 million. The terminal worth could possibly be $1.6 billion. I anticipate the exit a number of to be 8.1x and a WACC of 8.46%, which might end in an enterprise worth of $1.1 billion, fairness of $1.1 billion, and a good worth round $85 per share.

My DCF Mannequin

Below fairly detrimental macroeconomic circumstances, I imagine that demand for the corporate’s merchandise might decline. Consequently, the corporate might have loads of amassed stock, which can diminish the corporate’s profitability. If administration decides to take stock markdowns, relationships with suppliers might undergo. In sum, within the worst case state of affairs, an eventual lower in free money movement expectations may convey the inventory worth down.

Opposed financial circumstances and any associated lower in shopper demand for discretionary objects may have a cloth hostile impact on our enterprise, outcomes of operations and monetary situation. The merchandise we promote usually consists of discretionary objects. Diminished shopper confidence and spending might end in decreased demand for discretionary objects and should pressure us to take stock markdowns, lowering gross sales and making expense leverage troublesome to realize. Supply: 10-k

Genesco may fail to establish suppliers providing trending merchandise. Consequently, the corporate might provide merchandise that clients merely would not purchase. Let’s needless to say shopper tastes are very troublesome to foretell. Lack of demand for Genesco’s merchandise may convey the income development down, which can result in decreases in future free money movement.

The vast majority of our companies serve a fashion-conscious buyer base and rely upon the flexibility of our patrons and merchandisers to react to style developments, to buy stock that displays such developments, and to handle our inventories appropriately in view of the potential for sudden adjustments in style, shopper style, or different drivers of demand. Failure to execute any of those actions efficiently may end in hostile penalties, together with decrease gross sales, product margins, working revenue and money flows. Supply: 10-k

Lastly, I imagine that inflation may have a unfavourable impact on Genesco’s P&L assertion. If the corporate has to extend the worth of merchandise, and shoppers do not wish to pay, income development might decline. In addition to, if administration doesn’t wish to improve the worth of its merchandise, the free money movement margin wouldn’t develop.

As well as, inflationary value strain on the merchandise we promote would possibly restrict our capacity to go on value will increase leading to gross margin impression or decreased demand. Demand may also be influenced by different elements past our management. Supply: 10-k

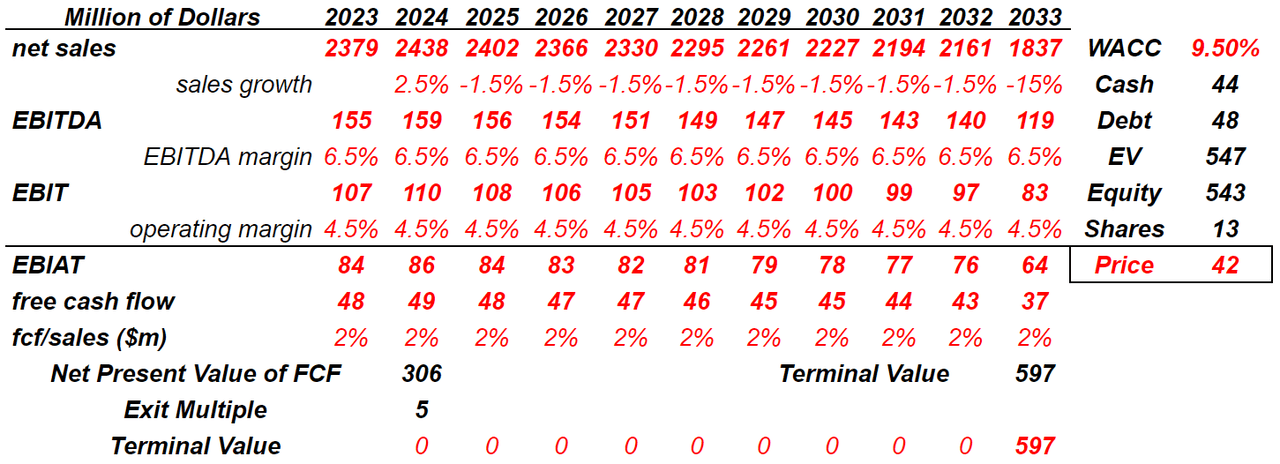

For 2033, I anticipate a internet gross sales of $1.83 billion, with the gross sales development of -15% along with an EBITDA of $119 million, with an EBITDA margin of 6.5%. I anticipate EBIT to be $83 million together with an working margin of 4.5%. The EBIAT will doubtless be $64 million. I anticipate the free money movement of $37 million and the FCF/gross sales of two% million. I estimate a internet current worth of FCF of $306 million. The terminal worth could possibly be $597 million. With a WACC of 9.50%, I obtained an enterprise worth of $547 million, fairness of $543 million, and a good worth of $42 per share.

My DCF Mannequin

Conclusion

Genesco runs a worthwhile enterprise mannequin with useful agreements with giant suppliers. The corporate is doing nice contemplating that retailer rely is predicted to extend within the close to future. For my part, additional digitalization, acquisitions, and proper choice of new shops may convey the inventory worth to round $85 per share. I do see dangers from eventual lack of demand for the corporate’s merchandise and adjustments in buyer developments. With that, I imagine that the low cost of future free money movement implies a valuation that’s extra important than the present inventory worth.