Editor’s notice: Searching for Alpha is proud to welcome Mark Chantler as a brand new contributor. It is easy to develop into a Searching for Alpha contributor and earn cash on your greatest funding concepts. Lively contributors additionally get free entry to SA Premium. Click on right here to seek out out extra »

ASOS | Nordstrom Pop-Up At The Grove In Los Angeles Gonzalo Marroquin

Shares of ASOS Plc (OTCPK:ASOMY)(OTCPK:ASOMF) have continued to say no because of the headwinds they’re at the moment dealing with. We imagine that it is a non permanent blip in an exceptional 20-year monitor report of worthwhile development, and that ASOS will survive and return to worthwhile development within the medium time period. Even at properly beneath historic ranges, this could ship >35% IRR’s for shareholders from at this time’s share worth.

Enterprise Introduction

Contents

- 1 Enterprise Introduction

- 2 Key Financials

- 3 The Enterprise Mannequin

- 4 Share Worth Decline

- 5 Core Funding Thesis

- 6 1. Will ASOS Survive?

- 7 2. Will ASOS Return to Revenue?

- 8 3. Will ASOS Return to Development?

- 9 The Administration Group and Incentives

- 10 Opponents

- 11 ASOS’s Aggressive Benefits

- 12 20-Somethings:

- 13 Trend With Integrity:

- 14 Model Moat:

- 15 Key Financial Dangers and Variables

- 16 Return to Profitability:

- 17 Income Development:

- 18 Valuation

- 19 Conclusion

ASOS began in 2000 with the thought of sourcing clothes that individuals noticed in films, on TV reveals, or worn by their favourite celebrities. Therefore, the title ASOS is an abbreviation of “as seen on display.” It has since grown right into a £4Bn turnover vogue e-tailer whose imaginative and prescient is “to develop into the world’s number-one vacation spot for fashion-loving 20-somethings.” It listed on AIM in 2001 and on the primary LSE in February 2022.

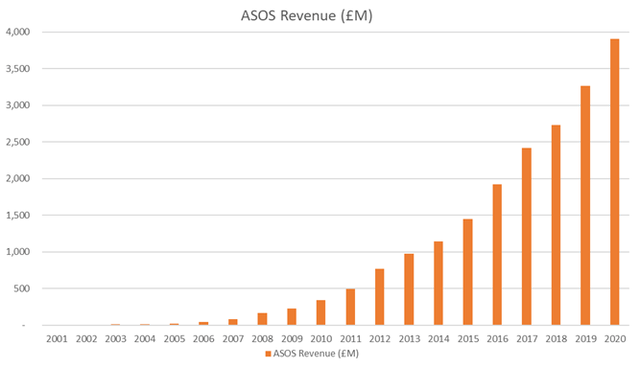

Via its app and web site, ASOS markets and sells >100,000 totally different vogue merchandise throughout 200 markets in 10 languages. These comprise 17 of ASOS’s personal manufacturers (c. 40% of gross sales) and 850+ different manufacturers (c. 60% of gross sales). ASOS has grown income each single 12 months since its inception, averaging a 28% CAGR for the final 10 years, from £340M to £3,910M. Initially a UK enterprise, it moved into Europe, the U.S., and the remainder of the world and has been current in these markets for over 10 years. ASOS now has 26.4M lively prospects with achievement and returns facilities within the UK, EU, and the U.S. It employs 3,000 folks throughout vogue, operations, and IT.

ASOS is at the moment present process a myriad of headwinds together with provide chain disruptions, inflationary pressures, inflated inventories, enormous administration adjustments, and even newspaper stories of a buyer being delivered broken items. Because of this, the share worth has fallen 90% within the final 18 months from a £5.7Bn market cap to £540M, and EBIT has been worn out from £190M in FY21 to £20M (forecast) in FY22.

Key Financials

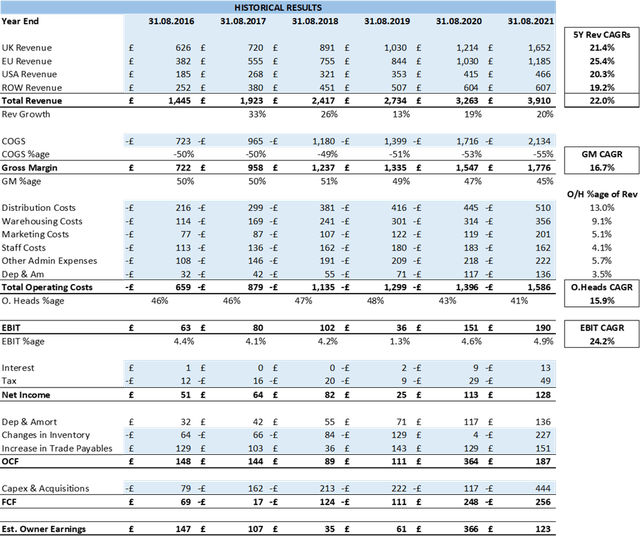

ASOS Historic Financials (ASOS Monetary Studies)

The Enterprise Mannequin

ASOS operates a hybrid mannequin of promoting its personal manufacturers and associate manufacturers. We view the enterprise mannequin in three – closely interlinked – components:

- ASOS Manufacturers (Create): 17 personal manufacturers with £1.4Bn in gross sales offered on the ASOS platform and wholesaled to associate platforms to increase their attain.

- ASOS Platform (Curate): Offering every little thing vogue associated for 20-somethings on one platform and utilizing information and the Premier subscription service to enhance the client expertise and operational effectivity. This has additionally just lately expanded into ASOS Providers, which makes their model companions their buyer for promoting and achievement companies.

- ASOS Expertise (Convert): A world community of achievement facilities and returns facilities that may provide subsequent day supply and free returns.

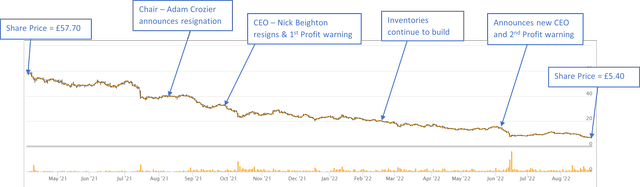

Following a share worth rally from £12 in March 2020 as much as £55.70 in March 2021, it has since been an 18-month lengthy, >90% worth decline from £55.70 (£5.7Bn market cap) to £5.40 (£540M market cap). That is because of the administration adjustments, revenue warnings, and the financial surroundings ASOS has discovered itself in.

ASOS Share Worth Decline

Core Funding Thesis

Lots of ASOS’s issues – particularly provide chain points, inflation, and the chance of a recession – are being confronted by all vogue e-tailers which have additionally suffered giant share worth declines within the final 12 months. As an illustration, Boohoo (OTCPK:BHOOY) is down 91% and Zalando (OTCPK:ZLNDY) is down 79%. As well as, ASOS has had sudden and wide-ranging administration adjustments.

ASOS share worth is now at its lowest stage in 12 years (when it was roughly 5% of the scale it’s at this time). It’s priced at <3x its peak EBIT in FY21 and 51% of ebook worth. It is comparatively cheaper than each of its predominant rivals in Boohoo and Zalando, being priced properly beneath a distressed acquisition worth.

Our funding thesis for ASOS is predicated on answering three questions:

- Will ASOS survive? We’ll present that ASOS has the liquidity wanted to outlive a really robust financial surroundings.

- Will ASOS return to revenue? We will see a transparent route for ASOS to return to low-mid single digit EBIT margins.

- Will ASOS return to development? We imagine ASOS’s present stall in development is non permanent and that their 20-year monitor report of worthwhile development will proceed as soon as they’ve overcome their points.

If ASOS returns to even reasonable development and profitability ranges – far beneath historic ranges – we must always anticipate >35% IRR, with enormous further upside if administration can ship their medium-term objectives set out in October 2021.

1. Will ASOS Survive?

ASOS have entry to a few predominant traces of debt: £500M in convertible bonds (at 0.75% rate of interest, out to April 2026); £350M revolving credit score facility (obtainable till July 2024, stays utterly undrawn) and a £22M mortgage from Nordstrom (at 6.5% rate of interest, reimbursement not due for greater than 5 years). Yr-end steering is for internet debt to extend to £210M (after altering the therapy of the convertible bonds to all debt).

To emphasize check ASOS’s liquidity, we have now taken very prudent assumptions on their efficiency going forwards of: zero income development, 0% EBIT in FY23, then 1.5% EBIT from FY24; RCF expires in July 2024 and isn’t changed; convertible bonds expire April 2026 and are usually not changed; and inventories stay at peak highs and capex continues at £200M per 12 months, regardless of delivering no development.

On this state of affairs, ASOS would have £662M of liquidity in August 2022, dropping to £384M upon expiry of the RCF in 2025 after which (£61M) when the convertible mortgage notes have to be repaid in April 2026. ASOS’s inventories are at the moment at report highs of 173 days’ price of COGS. If ASOS might cut back their stock ranges again to the five-year common of 128 days, this may add +£280M of liquidity to those figures.

2. Will ASOS Return to Revenue?

Gross margins have been squeezed since FY18 from 51.2% to 45.4% in FY21, and 43.5% (forecast) in FY22. That is a complete decline of seven.7%. This is because of elevated promotional exercise and regional pricing (1.5%), elevated freight and obligation prices (3.2%), decrease margin gross sales combine throughout COVID (2.8%), and enhanced clearance exercise in spring/summer time 2021 (1.6%), offset by improved shopping for margin +1.6%.

Administration doesn’t anticipate gross margins to return to >50% within the medium time period, however is anticipating them to get again to 47%-48% and EBIT margins to be >4%. For our base case to carry true, we have to see a method again from 0% EBIT in FY22 to three% inside the subsequent 5 years. Given the diploma of uncertainty, we would wish to see levers properly above 3% for ASOS to realistically return to profitability. We divide these margin alternatives into two buckets:

A) Distinctive/COVID-related prices, which ought to naturally enhance: enhanced clearance exercise not recurring +1.5%, inflated freight prices, now declining +1.5%, and the full-year impact of worth will increase already in place +1%-2%.

Common freight prices – Sept ’20 to Sept ’22 (Freightos Information )

B) Actions and investments to enhance margin: continued funding in automation at Atlanta and Lichfield +0.5-1%, continued price mitigation +1%, advertising and marketing spend +0.5%, improved shopping for margin via material consolidation and native sourcing +0.5-1%, and charging for returns +2-3%.

Returns are a key swing think about ASOS’s revenue, and the corporate has already applied worth will increase for his or her highest return objects. ASOS, Zalando, and Shein nonetheless provide free returns, however Boohoo, Subsequent, and Zara cost £1.99-£2.50 per parcel (Boohoo introduced of their returns cost in July 2022).

ASOS ships 95,200 order per 12 months. Assuming returns stand at 30% at this time, a return cost of £1.99 per parcel (to match Boohoo) would generate between £57M (if 30% of orders have been returned in full) and £190M (if one merchandise from each order was returned). It will likely be neither of those extremes, however someplace in between, so 2%-3% of income is a wise assumption.

The above actions might add 9.5%-11.5% to ASOS’s margins. We aren’t suggesting that ASOS might enact all these measures with out a detrimental impression on the client expertise and gross sales, however it’s price noting that they’ve a lot of levers they’ll pull to deliver margins again up over time, and that 4%-5% of this improve ought to roll via robotically.

3. Will ASOS Return to Development?

ASOS Income Development (ASOS Financials)

ASOS has grown revenues each single 12 months because it was based in 2000. From FY21 to FY22, though ASOS has not stopped rising in nominal phrases, the +2% income development from FY21 to FY22 gross sales figures definitely represents an actual decline in gross sales. Quite than a sudden finish to ASOS’s long-term development or an business shift again to the excessive avenue, we imagine that FY22 is an anomaly pushed by gross sales pull ahead through the pandemic, provide chain points, and a change in client spending, as extra was spent on experiences over vogue.

ASOS estimates its TAM at £326Bn, giving ASOS simply 1.2%. Statista expects the style e-commerce market to develop by 9.1% CAGR to 2025. Whereas income development is necessary for the long-term success of ASOS, returning to profitability is a far larger driver of funding returns for the following 5 years. If margins enhance to three% EBIT, however ASOS’s gross sales don’t develop in any respect, we nonetheless anticipate an IRR of >25%.

The Administration Group and Incentives

Jose Calamonte (the brand new CEO) was appointed in June 2022. He’s clearly clever (having attended MIT and labored at McKinsey) and has a vogue background (having labored for Indetex, Esprit, and Salsa Denims). He’s an inner promotion from CCO the place he was an integral a part of “Trend With Integrity” and the medium-term monetary plans for ASOS.

Jørgen Lindemann (the brand new chairman) has an enormous quantity of expertise in digitally lead companies. He’s chair of Miinto, the Danish-based on-line vogue market, and is on the board of Bambuser AB, the Swedish-based international dwell video purchasing expertise firm. He additionally sat on the board of Zalando as a non-executive director from 2016 to 2021.

The CEO and chairman have a substantial amount of related expertise and, having listened to each converse for a number of hours, they arrive throughout as passionate, partaking, and clever (as you’d anticipate). They’re each inner promotions and have been concerned within the plans laid out on the Capital Markets Day in November 2021. We might often see this as large constructive, however they have been each new joiners to ASOS in 2021 and as such hadn’t spent a substantial amount of time within the enterprise earlier than getting promoted. The administration change creates additional uncertainty in ASOS and is one thing we’ll monitor rigorously within the coming months and years.

Trying on the construction and quantum of ASOS’s long-term incentive scheme (ALTIS), we discover the motivation scheme truthful and proportionate to ship shareholder worth. If even the brink payout of ALTIS is achieved, shareholders ought to anticipate a 5x-10x return on their funding within the subsequent three years, far above even our bull case.

Opponents

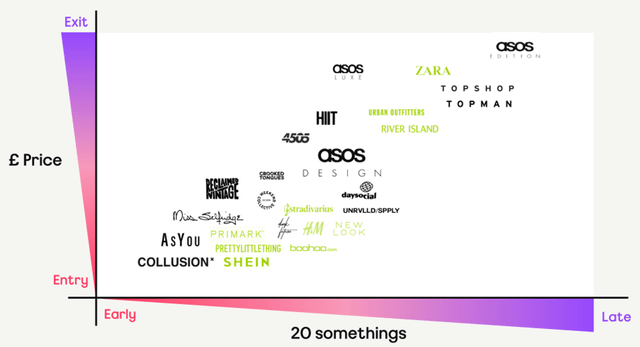

The ASOS manufacturers have many rivals, relying on the age and worth level of the goal buyer:

ASOS Manufacturers Opponents (ASOS Capital Markets Day)

ASOS’s predominant platform rivals are Boohoo, Shein, and Zalando.

Boohoo is a UK-listed vogue e-tailer with c. £2Bn in revenues. The corporate solely sells its personal manufacturers and customarily focuses on the cheaper finish of the market.

Shein is the world’s largest vogue e-tailer with a turnover of $16Bn (c. £14Bn) throughout 220 nations. A personal enterprise that raised $1bn in April 2022, valuing the enterprise at $100bn, Shein solely sells its personal manufacturers and is actually quick vogue, including a median 2,000 objects to its retailer per day.

Zalando is a €10Bn (c. £8.5Bn) income enterprise that sells third-party manufacturers throughout Europe and has the ambition to go from 3% of vogue gross sales in Europe to 10%.

Each Boohoo and Shein have been linked to a lot of scandals round working circumstances and underpayment of their provide base, company governance points and accusations of plagiarism. We imagine that both Shein or Zalando may very well be viable acquirers of ASOS. Shein was the underbidder to ASOS on the Arcadia manufacturers and Zalando’s largest shareholder (the Bestseller/Povlsen household) can be ASOS’s largest shareholder. They each commerce at vital premiums to ASOS, presenting a big a number of arbitrage for both competitor at 4x-5x ASOS’s present worth, with the addition of giant synergies a commerce purchaser ought to anticipate.

ASOS’s Aggressive Benefits

20-Somethings:

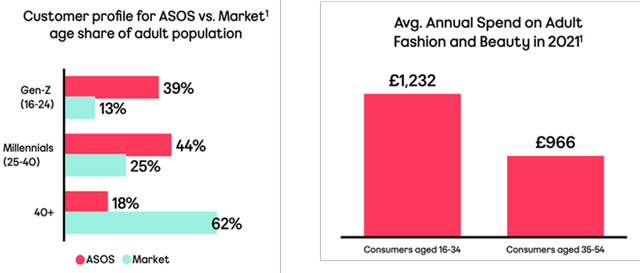

We view ASOS’s mission of being the go-to “vacation spot for fashion- loving 20-somethings” as a aggressive benefit. 83% of ASOS’s prospects are below 40, and the common age of an ASOS buyer has stayed fixed at 28/29 for the final 10 years.

We imagine that age demographic is the fitting method to orientate the enterprise, slightly being centered on solely its personal manufacturers (like Boohoo and Shein) or solely third-party manufacturers (like Zalando). We additionally imagine that 20-somethings is the fitting age to concentrate on, as they have an inclination to have the next concentrate on vogue and enhanced spending on vogue.

ASOS Buyer Base (ASOS Capital Markets Day)

Trend With Integrity:

Trend is the third-largest manufacturing business on the earth and, by some calculations, it produces as much as 10% of the world’s emissions. In contrast to some key rivals, ASOS has taken ESG significantly since they launched FWI again in 2010. ASOS carried out a materiality research in 2020 to replace its targets and is specializing in the areas its stakeholders care most about: “be internet zero, be extra round, be extra clear, and be various.”

ESG is necessary issue for ASOS’s goal demographic. We imagine FWI offers ASOS a aggressive benefit when prospects select the place to buy, but in addition in avoiding scandals which have harm their rivals prior to now.

Model Moat:

We might describe each the ASOS platform and ASOS manufacturers as having a reasonable model moat. ASOS has 13.8M Instagram followers and the app has been downloaded tens of tens of millions of occasions. They’re driving loyalty via their concentrate on 20-somethings, FWI, rewards for college kids, and their premier program.

ASOS describes its Topshop model as iconic and feels different manufacturers (like Collision) might additionally develop into iconic within the medium time period. That stated, they clearly can not command the kind of model energy and premium that genuinely iconic manufacturers reminiscent of Coca-Cola, Ferrari, or Gucci can.

Key Financial Dangers and Variables

Our funding success will rely upon ASOS’s capacity to return to low-single-digit EBIT margins and to develop revenues within the medium time period. Given ASOS’s present points and the financial surroundings, we have now used prudent assumptions for each these metrics.

Return to Profitability:

- Base Case Assumption: This assumption is for ASOS to pattern again to three% EBIT over the following 5 years. This compares to a median 3.9% EBIT in L5Ys and administration steering of >4%.

- Influence of a Miss: Medium – if ASOS solely achieves a 2% EBIT, with the identical income development assumptions, then a 15x EBIT exit a number of nonetheless delivers >25% IRR.

- Threat of a Miss: Excessive – there’s a actual danger that inflation and a recession will push out the timeline of ASOS’s restoration. Nonetheless, we imagine ASOS can survive any affordable assumptions and that they are going to be well-placed when this surroundings does finish.

Income Development:

- Base Case Assumption: 0% development for FY23, then 8% CAGR FY23-FY27. This compares to 22% in L5Ys.

- Influence of a Miss: Low – 1% much less income CAGR, reduces IRR from 37% to 32%. Even 0% income development delivers >25% IRR if ASOS returns to three% EBIT Margins.

- Threat of a Miss: Medium – the income development assumptions used are already prudent when in comparison with historic ranges and delayed by a 12 months. A really giant recession might push this again additional, although.

Valuation

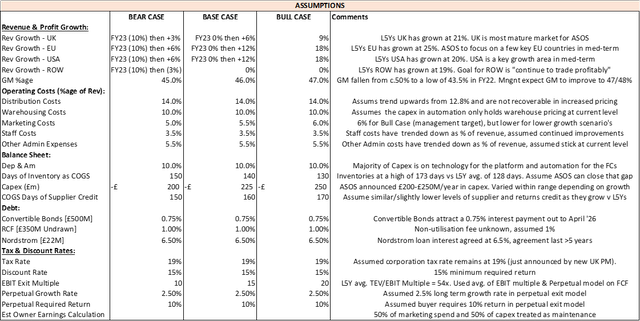

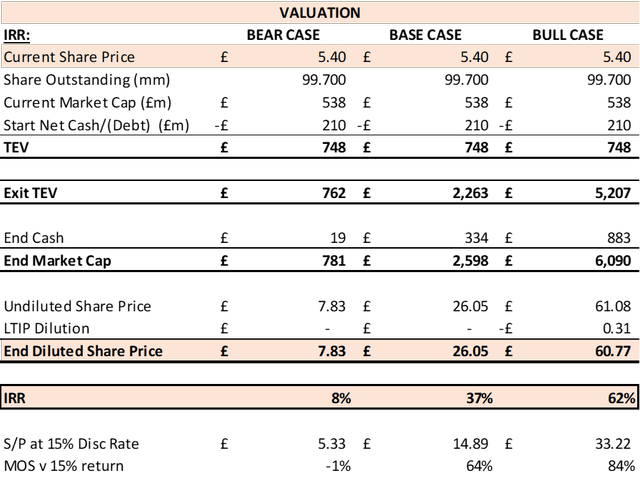

Key Valuation Assumptions (personal information) ASOS Valuation (Bear, Base & Greatest Case)

The bottom case valuation assumes that ASOS doesn’t begin to get well for one more 12 months from at this time (with FY23 matching FY22 at 0% income development and 0% EBIT). We then develop revenues by 8% CAGR (vs. 22% in L5Ys) and enhance EBIT to three% (vs. 3.9% common for L5Ys). The exit a number of used is then 15x EBIT (vs. 54x common for L5Ys).

Even with these prudent assumptions, we produce a 37% IRR with an upside to 62% if administration hits their medium-term steering.

Conclusion

ASOS operates in a tight-margin and extremely aggressive house. We like ASOS’s method to the 20-somethings market, its flexibility to promote each its personal and third-party manufacturers, and the truth that it has averted – and will proceed to keep away from – the scandals that Boohoo and Shein have confronted by taking sustainability and provide chain transparency significantly.

For a lot of of ASOS’s headwinds, the worst ought to already be behind it (provide chain points, freight price spikes, and stock construct). For others, they could proceed for a while (excessive inflation and a squeeze in client spending) however are finally non permanent.

To mannequin a breakeven state of affairs from ASOS’s present share worth, you need to assume that – over the following 5 years – ASOS spends £1Bn in capex and £1.1Bn in advertising and marketing, regardless of not rising revenues, and solely makes 1% EBIT margins and sells for 12x EBIT/1.5x EBITDA. Given ASOS’s unbelievable monitor report of worthwhile development because it was based over 20 years in the past, we see this as extremely unlikely.

We really feel that ASOS has each a big worth to worth hole in opposition to its present share worth, and that ASOS’s worth will proceed to develop over time. The timing of a restoration is extremely unsure, and can be largely pushed by exterior elements. However this has been factored into our base case assumptions, with a 12 months’s delay in any restoration and decrease development charges and EBIT ranges going ahead.